| You are in: Business | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

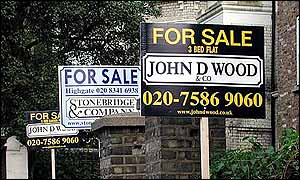

| Monday, 5 August, 2002, 06:39 GMT 07:39 UK No let up in UK house price boom  UK house prices are rising at an annual rate of more than 20%, according to the latest survey from the Halifax bank.

The figures tally with the most recent house price survey from rival mortgage lender Nationwide, which last week put the annual increase at 21%. Both surveys suggest that British house prices are rising at their fastest rate since 1989, when the property market was in the grip of its biggest ever boom. Stockmarket fall-out The housing market's sustained strength defies recent predictions that plunging share prices would depress demand for property. London's FTSE 100 share index has lost about a third of its value so far this year, eroding pension funds and depleting household wealth. There has also been speculation that overheating in the property market could lead to a full-blown crash similar to the one which ended the house price boom in the late 1980s. The collapse in property prices in the early 1990s left many homeowners repaying mortgages that were higher than the value of their houses. Moderation But Halifax reassured jittery house buyers that a crash is not on the cards this time round. "The UK housing market has been very strong in 2002 and July was no exception," said Halifax head of group economics Gary Styles. "Indicators of housing market activity confirm a buoyant but slowing market." The bank's estimate of monthly house price inflation for July was down from a 2.4% increase in June, in a sign that the pace of house price growth is already slowing. The bank said mortgages remain affordable thanks to low interest rates. It predicted that interest rate rises would take some of the heat out of the market in the months ahead, but said prices remained underpinned by a fundamental supply shortage. Interest rate outlook The latest survey will add to pressure for an increase in borrowing costs, currently at a 40-year low of 4%. Last week, the Bank of England decided to leave interest rates unchanged despite the house price boom, a move which analysts attributed to low inflation and concerns over the impact of the stock market slump. Halifax's latest snapshot of the housing market was in line with separate research released on Monday by the Royal Institute of Chartered Surveyors. RICS said house prices would rise by 19% this year, but predicted that growth would slow to just 7% in 2003. The organisation warned that galloping house prices are stretching the finances of some buyers, with the average house now costing 4.7 times average household income. The long-term average ratio of house prices to income is 3.4, RICS said. |

See also: 01 Aug 02 | Business 03 Jul 02 | Business 02 Jul 02 | Business 01 Jul 02 | Business 01 Jul 02 | UK 01 Jul 02 | Business 04 Jul 02 | Business Top Business stories now: Links to more Business stories are at the foot of the page. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Links to more Business stories |

| ||

| ---------------------------------------------------------------------------------- To BBC Sport>> | To BBC Weather>> | To BBC World Service>> ---------------------------------------------------------------------------------- © MMIII | News Sources | Privacy |