| You are in: Business | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

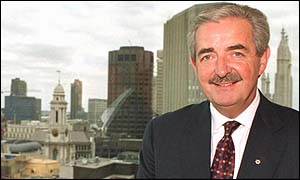

| Thursday, 1 August, 2002, 10:19 GMT 11:19 UK Barclays profits hit by double whammy  Matthew Barrett: "Our performance has not met our own high standards" Banking titan Barclays has blamed a double whammy of plunging share values and international crises for below-par results. The High Street giant, admitting its performance had not reflected its "own high standards", said that the fall in share values had hit income to its life assurance business.

Earnings were further hit by the unrest in Zimbabwe, which dragged down profits at the bank's Africa division by more than one quarter. And the Argentine crisis prompted the firm to increase to allow for default on more than half its debt exposure to the country. Operating profit fell 4% to �1.99bn for the first six months of the year, offering shareholders returns which, while "respectable" were "below the standards we set ourselves", chief executive Matthew Barrett said. But for the share falls and Argentina provision, operating profit would have risen by 8%, Mr Barrett said. Shares fall He also admitted that conditions remained "challenging", but said Barclays' "clear strategy" would guide its transformation into a "great" business. "It is uncertain times such as these that distinguish the great businesses from the good," he added. But his comments failed to reassure investors, with Barclays shares standing 31p, or 6.3%, lower at 458p in late morning trade, and dragging the price of stock in sector mates Lloyds TSB and Royal Bank of Scotland. "A 43% increase in provisions at Barclays is massive," said Jeremy Batstone, head of research at NatWest Stockbrokers. "The trend looks pretty bad." Argentina effect Argentina's ongoing financial crisis has included a currency devaluation, default on international debt and a freeze on savings withdrawals from banks. Barclays said it had reduced its raised its provision for bad debt in the country to �104m following advice from US regulatory authorities. But the bank added that its lending in Argentina had been restricted largely to subsidiaries of multi-national firms, rather than local ventures. "We have continued to receive repayments over the year," Mr Barrett said. | See also: 01 Aug 02 | Business 30 Jul 02 | Business 30 Jul 02 | Business 26 Apr 02 | Business 24 Apr 02 | Business Top Business stories now: Links to more Business stories are at the foot of the page. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Links to more Business stories |

| ||

| ---------------------------------------------------------------------------------- To BBC Sport>> | To BBC Weather>> | To BBC World Service>> ---------------------------------------------------------------------------------- © MMIII | News Sources | Privacy |